ROI vs ROAS: Which Metric Drives Real Profit for Your Shopify Store?

Confused about ROI vs ROAS? Learn the difference and see which metric truly measures eCommerce profitability. Optimize your ad spend and scale your DTC brand.

You’re staring at your Shopify dashboard. A fresh Meta Ads campaign just hit a 5x ROAS, and for a second, you feel that founder’s rush. You’ve cracked it. But then you glance at your bank balance, and that familiar, sinking feeling creeps in. The numbers in your ad reports look great, but the cash flow tells a different story. Where did the profit go?

This gap between flashy ad metrics and actual profitability is one of the most common—and costly—traps for ambitious DTC founders. It all comes down to a fundamental misunderstanding of two key metrics: ROAS (Return on Ad Spend) and ROI (Return on Investment).

At its core, the difference is simple. ROAS measures the gross revenue you get back for every dollar you spend on ads. ROI, on the other hand, measures the actual profit you're left with after all your costs are paid.

Think of it this way: ROAS tells you if your ads are making the phone ring. ROI tells you if you're actually making money from those calls.

The Hidden Profit Drain in Your Shopify Ad Reports

That killer ROAS that looks so good in your ad manager? It’s a vanity metric if you look at it in isolation. Relying on it alone is like trying to drive a car by only looking at the speedometer—you know how fast you're going, but you have no idea if you're about to drive off a cliff.

You see a 5x ROAS and think you've struck gold. So you double down, pouring more cash into the campaign, confident you're scaling a winner. But that one number doesn't tell the whole story. It completely ignores all the other costs that are quietly eating away at your profit margin on every single sale.

Beyond Ad Spend: The Costs Hiding in Plain Sight

For any Shopify store, the real cost of getting a product into a customer's hands goes way beyond the ad click. When you're talking about real profitability, you have to look at the full picture.

ROAS conveniently sidesteps all of these:

- Cost of Goods Sold (COGS): What it actually costs you to make or buy the products you sell.

- Shipping and Fulfillment: Every box, label, and postage fee adds up.

- Transaction Fees: The slice Shopify and your payment processor take off the top of every order.

- Software Subscriptions: All those monthly fees for your email platform, review apps, and other tools.

- Salaries and Agency Fees: The people and partners who make it all happen.

| Metric Focus | ROAS (Return on Ad Spend) | ROI (Return on Investment) |

|---|---|---|

| Perspective | Tactical (Campaign-level) | Strategic (Business-level) |

| Calculation | (Revenue from Ads) / (Ad Cost) | (Net Profit) / (Total Investment) |

| Answers | "Are my ads generating sales?" | "Is this entire effort profitable?" |

| Typical Use | Optimizing ad creatives and bidding | Evaluating overall business health |

This guide will cut through the noise. We'll break down how to use both ROAS and ROI to make decisions that actually grow your Shopify brand’s bottom line. More importantly, we’ll show you how AI-powered analytics tools like MetricMosaic replace manual data crunching by pulling all this fragmented data together, giving you a crystal-clear view of your financial health without living in spreadsheets.

Comparing ROI and ROAS for DTC Brands

For any fast-growing Shopify brand, the difference between Return on Investment (ROI) and Return on Ad Spend (ROAS) isn't just semantics. It’s the critical line between scaling profitably and accidentally scaling your way into a cash flow disaster.

The core distinction comes down to perspective. Think of ROAS as your tactical magnifying glass and ROI as your strategic wide-angle lens.

ROAS gives you a clean, uncluttered look at how efficient your ads are. It answers one simple but vital question: "For every dollar I spent on this Meta campaign, how much revenue did I get back?" It's a frontline metric, perfect for performance marketers who need to decide—right now—which ad creative to double down on or which audience to kill.

ROI, on the other hand, zooms out to see the entire battlefield. It asks the ultimate founder question: "After we've paid for the product, the shipping, the software, and the team, are we actually making money?" This is the number that matters to your bottom line, your investors, and the long-term health of your business.

Formulas: The Hidden Costs in Plain Sight

The real story behind the roi vs roas debate is buried in what each formula includes—and, more importantly, what ROAS conveniently leaves out.

The calculation for ROAS is simple and all about revenue:

ROAS = (Revenue from Ad Campaign) / (Cost of Ad Campaign)

For example, if you spend $1,000 on a Google Ads campaign and it pulls in $4,000 in sales, your ROAS is 4x (or 400%). This tells your marketing team that the ads are doing their job generating top-line revenue. Success, right? Not so fast.

Now let’s look at ROI, which is profit-focused and brutally honest:

ROI = [ (Revenue - Total Costs) / Total Costs ] * 100

Let's use that same example but factor in the real costs. That $4,000 in revenue came from products with a Cost of Goods Sold (COGS) of $1,500. Shipping and fulfillment added another $500, and payment processing fees took a $120 slice. Suddenly, your total cost isn't just the $1,000 ad spend; it's $3,120 ($1,000 + $1,500 + $500 + $120).

Your actual net profit is just $880 ($4,000 - $3,120). This puts your ROI at a much more sobering 28.2%. A 4x ROAS feels fantastic, but a 28% ROI reveals the true profitability of that effort.

ROAS measures revenue efficiency, but ROI measures profit reality. You can have an incredible ROAS and still lose money on every sale if your margins are too thin or operational costs are out of control.

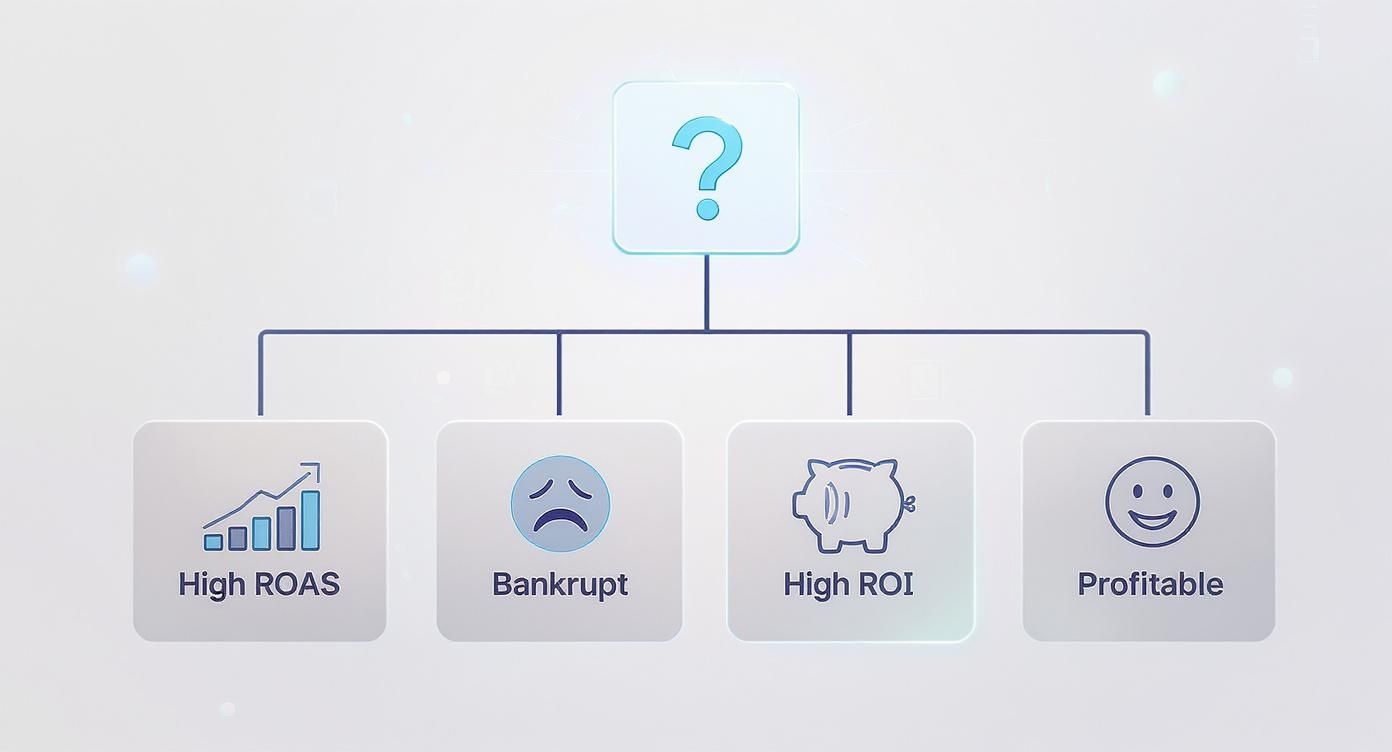

This flowchart shows exactly how these two different paths can play out.

As you can see, chasing high ROAS without an eye on the bigger picture can lead you straight to bankruptcy. A healthy ROI, however, is the only true path to sustainable profit.

When to Use Each Metric

To help you get a better handle on this, here's a quick breakdown of the core differences between ROI and ROAS and when to lean on each one.

Key Differences Between ROI and ROAS

| Attribute | ROAS (Return on Ad Spend) | ROI (Return on Investment) |

|---|---|---|

| Primary Goal | Measures the direct revenue efficiency of specific ad campaigns. | Measures the overall profitability of a full business initiative. |

| Scope | Tactical and short-term. Narrowly focused on ad spend vs. revenue. | Strategic and long-term. A holistic view of all costs and investments. |

| Use Case | Optimizing daily/weekly ad performance, A/B testing creative, and shifting budget between campaigns on a single platform. | Making high-level business decisions, evaluating channel profitability, planning quarterly budgets, and assessing company health. |

| Who Cares Most | Performance Marketers, Media Buyers, PPC Specialists. | Founders, CEOs, Finance Teams, Investors. |

Understanding this distinction lets you apply the right metric to the right conversation, turning raw data into much smarter decisions. Of course, calculating this manually across every channel is a nightmare. This is where AI-powered analytics platforms like MetricMosaic become invaluable—they connect all these dots for you automatically, transforming complexity into clarity.

Why a High ROAS Can Mask Profitability Issues

That glowing 5x ROAS on your ad dashboard? It feels like a massive win. It’s the kind of number that makes you want to double down on your ad budget, thinking you’ve finally cracked the code for your Shopify store.

But here’s the hard truth: that single metric often creates a dangerous false sense of security. It can mask deep profitability issues that are quietly draining your business dry.

What if your product margins are razor-thin? Or what if skyrocketing shipping costs are eating away at every single sale that "successful" campaign generates? This is the critical disconnect between campaign performance and real business health that trips up so many DTC founders.

ROAS is a measure of revenue efficiency, not profit. Think of it as a tactical tool for your media buyers to optimize campaigns on the fly. For a founder making strategic financial decisions? It’s a terrible metric to use in isolation.

A Practical Shopify Case Study

Let's walk through a super common scenario. Imagine you run a DTC skincare brand and just launched a new Meta Ads campaign for your best-selling face serum.

Here’s what your ad platform shows you:

- Ad Spend: $5,000

- Revenue Generated: $25,000

- ROAS: 5x ($25,000 / $5,000)

Your marketing team is high-fiving. A 5x ROAS looks solid, and the campaign is clearly driving top-line revenue. But now, let’s peel back the layers and look at the numbers ROAS completely ignores—the numbers that actually determine if you made any money.

The Hidden Costs Behind the Sale

To get a real picture of profitability, we have to account for everything it cost to generate that $25,000 in sales.

- Cost of Goods Sold (COGS): Your products have a 40% profit margin, which means your COGS is 60% of revenue.

- COGS = $25,000 * 0.60 = $15,000

- Shipping & Fulfillment Costs: This is the average cost to pick, pack, and ship every order from that campaign.

- Total Shipping = $3,500

- Transaction Fees: Shopify Payments and other gateways take their cut, averaging 2.9%.

- Fees = $25,000 * 0.029 = $725

- Marketing Agency Fees: A portion of your agency’s retainer needs to be attributed to this campaign.

- Attributed Fees = $1,500

Now, let’s add it all up to find our true investment.

Total Costs = Ad Spend + COGS + Shipping + Fees + Agency Fees

Total Costs = $5,000 + $15,000 + $3,500 + $725 + $1,500 = $25,725

The reality hits hard. Even though you brought in $25,000 in revenue, your total costs were $25,725. That "fantastic" 5x ROAS campaign actually lost you $725.

Your ROI tells the real, painful story:

ROI = [ ($25,000 - $25,725) / $25,725 ] * 100 = -2.8%

This is a classic case of winning the battle but losing the war. The campaign was efficient at turning ad dollars into revenue, but the underlying business economics made every sale unprofitable. This is exactly why the roi vs roas debate isn't just academic—it's essential for survival.

Why This Disconnect Is So Common

This gap between a healthy-looking ROAS and a poor ROI is everywhere. One analysis found a company celebrating a 2.5x ROAS only to discover their actual ROI was a mere 150% after factoring in all operational costs. In another case, a seemingly great 4:1 ROAS translated to a disappointing 14.3% ROI, proving how easily top-line metrics can hide serious profitability holes.

To avoid this trap, you absolutely must know your break-even ROAS. This is the ROAS you need to hit just to cover all your product and operational costs for an order. Anything above it is profit; anything below it is a loss. Without this number, you're flying blind.

This is the exact problem that AI-driven analytics platforms like MetricMosaic were built to solve. By automatically pulling in data from Shopify, your ad platforms, and your shipping providers, they connect campaign metrics directly to your bottom line. You get a clear, immediate view of your true ROI, moving you from relying on vanity metrics to making decisions based on real financial impact.

Applying ROI and ROAS to Your Marketing Channels

Knowing the theory behind ROI and ROAS is one thing. Actually applying it to your day-to-day operations is where you start making smarter, more profitable decisions for your Shopify store. The secret is knowing which metric to use for which channel, and when.

Let's walk through how to put these metrics to work across the channels you use every day, shifting from tactical tweaks to strategic growth.

Paid Channels: ROAS for Real-Time Optimization

For your paid ad channels like Meta Ads (Facebook and Instagram) and Google Ads, ROAS is your tactical co-pilot. These platforms are built for quick iteration and immediate feedback, which makes ROAS the perfect metric for getting in the weeds and optimizing on the fly.

You should be using ROAS to answer daily and weekly questions like:

- Which ad creative is pulling in the most revenue per dollar spent? A/B test your images and copy, and let ROAS tell you which versions to put more budget behind.

- Is my "Prospecting" audience more efficient than my "Retargeting" audience? Compare the ROAS between different ad sets to figure out where your ad spend is working hardest.

- Should I tweak my bidding strategy? Keep an eye on ROAS to see if automated bidding strategies are actually hitting your efficiency goals.

The name of the game here is speed. ROAS gives you a fast, clean signal to make quick adjustments that boost campaign efficiency. A climbing ROAS on a specific ad set is a great sign that you're hitting the mark with your targeting and creative.

SEO and Content Marketing: ROI for Long-Term Value

Channels like SEO, content marketing, and email marketing play a different game entirely. There’s no direct, one-to-one "ad spend" to plug into a simple ROAS formula. These are long-term investments you make in building an audience and an organic footprint.

For these efforts, ROI is the true measure of success. It makes you account for all the associated costs—freelancer fees, software tools, your team's salaries—and weigh them against the profit generated over the long haul.

Calculating the ROI of your organic channels helps you answer bigger, more strategic questions:

- Is our investment in blog content actually paying off over six months? Track the revenue coming from organic search traffic and compare it to what you spent producing that content.

- How does our content impact Customer Lifetime Value (LTV)? See if customers who find you through SEO end up having a higher LTV than those from paid ads.

- How does our organic traffic affect our overall Customer Acquisition Cost (CAC)? A strong organic presence naturally lowers your blended CAC, making your entire marketing engine more profitable.

ROI for organic channels isn't about the quick win; it's about building a sustainable, profitable asset. It measures the long-term health and profitability of your brand's very foundation.

Setting Realistic Benchmarks

So, what’s a “good” ROAS or ROI? The honest—and slightly frustrating—answer is: it depends. Your industry, product margins, and business model all cause huge swings in what to expect.

The data makes this clear. One analysis of 52 clients showed that PPC ROAS could be as low as 1.10x for IT services but 1.55x for legal services. On the flip side, organic channels can deliver massive returns, with one medical device company hitting a 12.85x organic ROAS. A generally healthy marketing ROI is often cited as being between 200% and 500%.

This data brings up a critical lesson in the roi vs roas debate: a high ROAS can be deceiving. For example, an engineering firm’s $150,000 marketing budget generated $160,000 in revenue, resulting in a seemingly decent 2.13x ROAS on ad spend. But their total ROI was only about 6.67%. It’s a stark reminder that ROAS alone doesn't show you the full profitability picture. You can discover more insights about these ROAS statistics to better contextualize your own performance.

Instead of chasing generic industry numbers, the best approach is to set targets based on your unique financial reality. For any Shopify brand, this means connecting your marketing data directly to your COGS, shipping, and other operational costs. This is where AI-powered platforms like MetricMosaic really shine. They can automatically calculate your break-even ROAS and true ROI for each channel, turning a mess of data into a clear roadmap for profitable growth.

Unifying Your Metrics with AI-Powered Analytics

Let's be honest, the biggest hurdle to understanding your Shopify store's actual profitability is scattered data. Your ad spend is in Meta and Google, your COGS are somewhere in Shopify, and shipping costs are locked away in your 3PL's platform. Trying to duct-tape this all together is more than just a headache—it’s a surefire way to make costly mistakes and burn hours you don't have.

This is exactly where AI-powered analytics tools completely change the game for DTC brands. Instead of you chasing down the numbers, the right tool brings all the numbers to you, in one place.

Modern analytics platforms are built to connect all your essential data sources automatically, creating a single source of truth. Think of it as a central hub that constantly pulls in live data from:

- Your Shopify Store: Sales, revenue, COGS, and customer data.

- Ad Platforms: Spend, impressions, and clicks from Meta, Google, TikTok, and more.

- Logistics Providers: Real-time shipping and fulfillment costs.

- Email & SMS Platforms: Campaign performance and attribution data from tools like Klaviyo.

This kind of integration puts an end to the manual data-crunching that slows your team down. You can stop spending your week exporting CSVs and fighting with spreadsheets and instead get instant, accurate insights into your brand's financial health. The conversation shifts from, "What do the numbers say?" to, "What's the smartest move we can make based on these numbers?"

From Data Overload to Story-Driven Insight

The real magic of AI in analytics isn't just about connecting dots; it's about turning that data into a clear story you can actually use. This is the new standard—moving away from static dashboards and toward dynamic, conversational analytics.

Imagine just asking your data a question in plain English, the same way you’d ask a colleague.

Instead of digging through ten different reports to figure out the ROI vs ROAS of a new campaign, you could simply ask your analytics tool: "What was the true ROI of our Black Friday campaign after all costs?" and get a clear, correct answer instantly.

This isn't some far-off concept; it’s what modern analytics deliver today. AI can sift through billions of data points in seconds to flag predictive insights and tell you what to do next.

For instance, an AI-powered co-pilot like MetricMosaic might tell you:

- "Your latest Meta campaign has a great ROAS of 4.5x, but its ROI is only 15%. The high shipping costs on that featured product are crushing your margins."

- "Customers from your blog content have a 30% higher LTV than those from paid search. Looks like your content marketing investment is paying off in a big way."

- "Your break-even ROAS for the new sneaker collection is 3.2x. The current prospecting campaign is only hitting 2.8x, which means you're losing money on every new customer from that ad set."

This kind of clarity turns your data from a confusing, backward-looking report into a strategic weapon. It frees you and your team from the grind of data assembly and lets you focus on what you do best—making smart decisions that grow your business profitably. Suddenly, the complex relationship between ROI and ROAS becomes simple, clear, and actionable.

From Data Insight to Profitable Action

Finally understanding the real difference in the roi vs roas debate is a huge first step. But for a Shopify founder, an insight without action is just trivia. The real magic happens when you turn that knowledge into a clear, profitable strategy. It's what separates the fast-growing DTC brands from the ones that get stuck.

The goal is to stop just knowing the numbers and start making them work for you. This means building a simple framework where both metrics have a specific job to do in your growth engine.

A Dual-Metric Framework for Growth

The easiest way to think about this is to see ROAS and ROI as tools for different altitudes. ROAS is your tactical, in-the-weeds guide for day-to-day tweaks, while ROI is your strategic North Star for the bigger picture.

Daily & Weekly Decisions (ROAS): This is your go-to for campaign-level adjustments. Is that new ad creative tanking? Is a specific audience segment crushing it? ROAS gives you the quick, clean signal you need to shift budget, kill a bad ad, or double down on a winner right now.

Monthly & Quarterly Planning (ROI): This is where you zoom out to check the actual health of your marketing channels and the business itself. ROI helps you ask the big questions: Is our investment in content marketing actually driving long-term profit? Are rising shipping costs silently making our Meta campaigns unprofitable?

ROAS tells you how fast your marketing campaigns are generating revenue from your ad spend. ROI tells you if you’re actually winning the race by measuring true profitability.

Building Your Profitability Dashboard

To make this framework truly work, you need a simple dashboard that gives you a constant pulse on your business's health. Let's be honest, trying to build this manually in spreadsheets is a soul-crushing chore that’s begging for errors.

This is exactly where an AI-powered analytics platform like MetricMosaic becomes a non-negotiable for any serious Shopify brand.

It pulls in your Shopify data, ad platforms, and all those other costs to give you an automated, real-time view of the KPIs that actually matter. At a minimum, your dashboard should track:

- Campaign-Level ROAS: For those quick, tactical checks on ad performance.

- Channel-Level ROI: To see the real profit being generated by Meta, Google, and your organic efforts.

- Overall Business ROI: The ultimate report card on your company's financial health.

By getting a handle on both metrics, you're setting your DTC brand up to scale sustainably. You’ll start making smarter, faster decisions that drive not just top-line revenue, but real, take-home profit.

ROI vs ROAS: Your Questions Answered

When you're in the trenches of running a Shopify store, metrics can get confusing. We get it. Let's clear up the most common questions we hear from founders about ROI vs ROAS so you can make decisions that actually grow your bottom line.

What’s a Good ROAS for My Shopify Store?

This is the million-dollar question, and the honest answer is: it completely depends on your profit margins. A brand with healthy 70% margins could be printing money at a 3x ROAS, while another brand with 30% margins would be bleeding cash at that same level.

Stop chasing vanity numbers. The only number that matters is your break-even ROAS—the point where you’ve covered your product costs, shipping, and fees. Anything above that is pure profit.

Can I Just Focus on ROI and Forget ROAS?

Not if you’re spending money on ads. Think of it this way: ROI is the ultimate health of your business, but ROAS is the tactical gauge your media buyer needs to optimize campaigns today. Ignoring it is like trying to tune an engine without a tachometer.

Your team needs ROAS for the daily grind of A/B testing creative and tweaking bids. Use ROAS as your short-term efficiency check and ROI as your long-term profitability compass. They work together.

How Do I Calculate ROI for SEO or Content Marketing?

Calculating ROI for organic channels is a different beast, but it’s doable. You just need to look at your investment over a set period, like a quarter.

Tally up all the related costs:

- Salaries for your content or SEO team (or agency retainers).

- One-off costs for freelance writers and designers.

- Subscription fees for your tool stack, like Ahrefs or Semrush.

Then, measure the net profit driven by organic traffic over that same timeframe. It's not as clean as paid ads, but it gives you a real sense of your content's long-term value and its impact on your P&L.

The biggest mistake we see founders make is using ROI and ROAS interchangeably. They aren't the same thing. ROAS is a simple ad-level ratio; ROI is a holistic profit calculation for a business initiative. Getting this right is fundamental to scaling sustainably.

How Does LTV Change the Conversation?

Customer Lifetime Value (LTV) is what separates good marketing from great marketing. A campaign might look weak on its initial ROI, but if it acquires customers who come back again and again, its true value is much higher.

Factoring LTV into your ROI calculation shows you the real, long-term profitability of a channel. It helps you justify spending more to acquire a customer today because you know what they'll be worth tomorrow. This is where predictive tools shine, helping you forecast that future value so you can invest with confidence.

Ready to stop guessing and get a crystal-clear view of your store’s profitability? MetricMosaic unifies your data to deliver AI-powered insights on ROI, ROAS, LTV, and more, turning complex numbers into your next profitable action. Start your free trial at https://www.metricmosaic.io.