The Customer Lifetime Value Formula for Shopify Growth

Unlock your Shopify store's true profit potential. Learn the customer lifetime value formula and see how LTV and CAC drive sustainable ecommerce growth.

Running a DTC brand on Shopify, you know the feeling. You're drowning in data from a dozen different places—Shopify, Google Analytics, Meta Ads, Klaviyo—and none of it tells a clear story. You're glued to your dashboards, obsessively tracking Return on Ad Spend (ROAS) and Customer Acquisition Cost (CAC), but these metrics only show a snapshot of a single moment. They tell you what just happened, but they give you zero clarity on long-term, sustainable profit.

Relying on those numbers alone is like trying to drive a car by only looking in the rearview mirror. This fragmented view often traps founders in a reactive cycle, throwing money at campaigns that deliver cheap clicks but attract low-value, one-and-done buyers. The real gold is buried in the patterns of repeat purchases and loyalty, something a standard Shopify report or a messy spreadsheet will never show you.

Moving Beyond Surface-Level Shopify Metrics

The customer lifetime value formula isn't just another number for your dashboard. For a savvy Shopify founder, it's a North Star metric that connects marketing spend directly to real, sustainable growth.

It completely shifts your thinking from, "How much did this customer just spend?" to "How much is this customer actually worth to my business over their entire journey?"

For a DTC brand, that perspective changes everything. It means you can:

- Justify higher acquisition costs for channels that bring in loyal, high-spending customers who stick around.

- Invest intelligently in retention, because you finally understand the dollar-for-dollar impact of keeping a customer happy.

- Make confident decisions on everything from product development to marketing campaigns and customer service.

Ultimately, LTV takes all that fragmented data and turns it into a clear, actionable growth plan. It’s how you move from the day-to-day chaos of disconnected metrics to the clarity of long-term value, building a data-driven engine for your Shopify brand.

What Is Customer Lifetime Value (and Why Should You Care)?

Let's break down one of the most important metrics you'll ever track: Customer Lifetime Value, or LTV (sometimes called CLV).

Think about your favorite local coffee shop for a second. Your value to them isn't just the $5 latte you bought this morning. It's the sum of every latte, croissant, and bag of beans you'll buy over the next five years. That's your LTV to them.

For your Shopify store, it’s the exact same idea. LTV is the total profit you can realistically expect from a single customer over their entire relationship with your brand. It’s a forward-looking metric that pulls your focus away from one-off sales and points it toward building profitable, long-term relationships. This shift in perspective is a total game-changer for building a business that lasts.

It's More Than Just One Sale

Thinking in terms of LTV forces you to zoom out. When you stop obsessing over a single transaction and see the bigger picture, you start making smarter decisions that actually grow your bottom line.

LTV is really just the financial measure of customer loyalty. It puts a dollar amount on the value of keeping customers happy, turning retention from a fuzzy concept into a core business driver.

It’s the number that helps you look past flashy, high-volume sales days and focus on what builds a truly healthy DTC brand.

LTV is Your Strategic North Star

Getting a handle on LTV isn't just some academic exercise—it’s the key to unlocking smarter growth. It gives you the clarity to navigate the often-choppy waters of eCommerce marketing and operations with real confidence.

Knowing your LTV lets you do things like:

- Actually Optimize Your Ad Spend: Suddenly, you can justify paying more to acquire a customer because you know they'll bring back 3x or 4x that cost over their lifetime. This is how you win bids against competitors and scale your ads profitably.

- Find Your Best Channels (for Real): LTV shows you which channels deliver the most valuable customers, not just the cheapest ones. A channel with a higher CAC might turn out to be your most profitable if its customers stick around and spend way more over time.

- Invest in Keeping Customers Happy: When you realize a loyal customer is worth hundreds or even thousands of dollars, spending on a better post-purchase experience, a loyalty program, or top-notch customer service becomes a no-brainer.

Ultimately, LTV is the bedrock of a resilient and profitable Shopify business. It ties everything you do—from marketing and product to customer support—back to the central goal of building lasting value.

How to Calculate LTV, From Simple to Predictive Models

Figuring out your LTV doesn’t need to be some intimidating, data-science-heavy project. You can actually start with a simple formula and work your way up to more powerful models as your brand scales.

Let's walk through the three main approaches, from a quick back-of-the-napkin estimate to the AI-powered predictions that give top DTC brands their edge.

The Simple Customer Lifetime Value Formula

For a fast and easy snapshot, the most common customer lifetime value formula is a perfect place to start. It just multiplies three key metrics you can pull right from your Shopify data to get a ballpark idea of what an average customer is worth.

The classic formula is: LTV = Average Order Value × Purchase Frequency × Average Customer Lifespan.

So, if your DTC brand has an AOV of $58, customers buy an average of 3.2 times a year, and they stick around for 2.5 years, your gross LTV is $464 ($58 × 3.2 × 2.5). While helpful, this simple formula is just a starting point.

This method gives you a solid baseline, but its main weakness is that it averages everyone together, which can hide some really important differences between customer groups.

The Cohort-Based LTV Model

This is where your analysis starts to get a lot smarter. Instead of lumping all your customers into one giant average, cohort analysis groups them by when they made their first purchase—usually by month or quarter.

For a Shopify store, this lets you track the LTV of customers you got during your Black Friday sale and compare them to customers you acquired in a slow summer month.

This approach uncovers some powerful trends:

- Campaign Impact: Did that new marketing campaign attract higher-value customers who stick around?

- Product Launches: Are customers who first bought your new product line more loyal?

- Seasonal Trends: Are customers you acquire in Q4 actually more valuable than those from Q1?

By comparing these cohorts, you move beyond a single, generic LTV number and start to see why certain customers are more valuable. It’s a huge step up from messy spreadsheets, showing you how your strategic decisions directly affect long-term profit. If you want to dive deeper, there's a complete guide to calculating Customer Lifetime Value (CLV) that breaks these methods down even more.

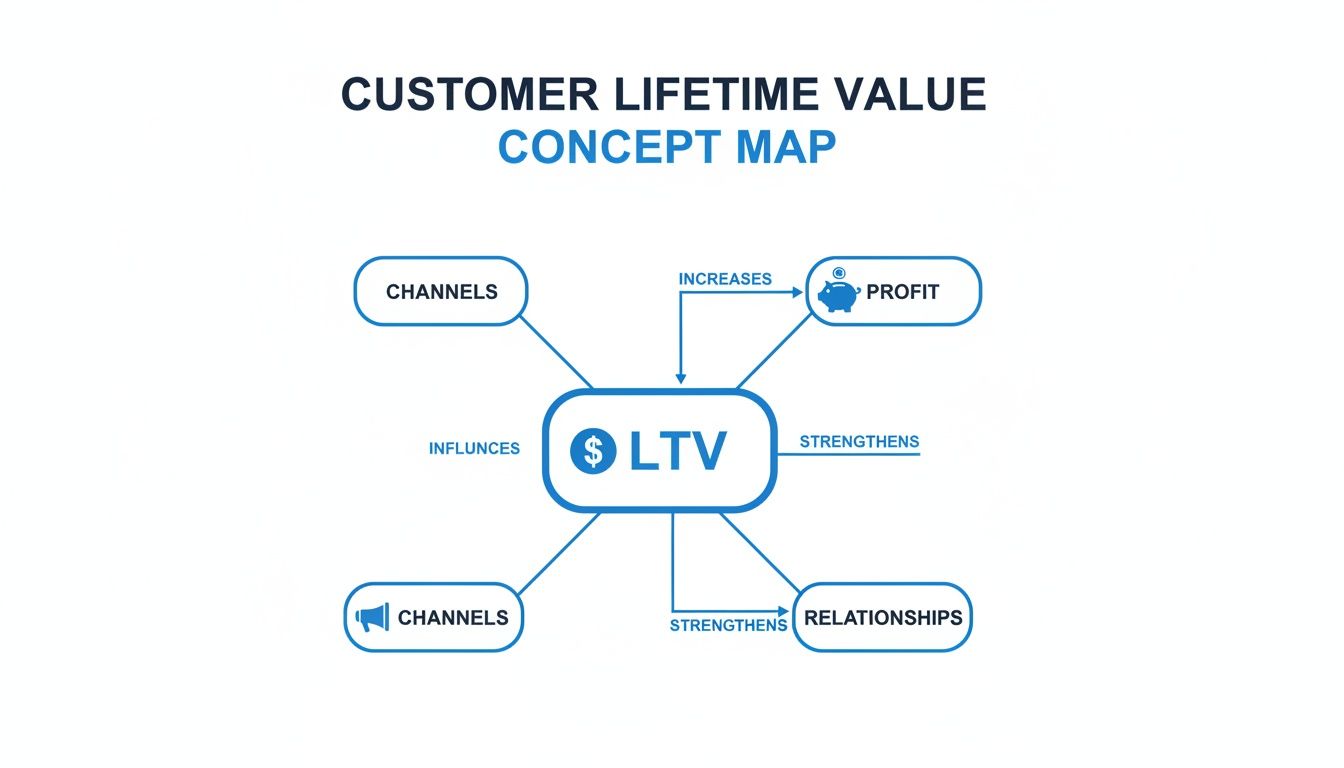

This concept map shows just how central LTV is—connecting profit, customer relationships, and your acquisition channels.

As you can see, LTV isn't just a number to track; it's the hub that influences your profitability and guides your entire marketing strategy.

To help you choose the right approach for your brand, here's a quick comparison of the three methods.

Comparison of LTV Calculation Methods

| Method | Formula Concept | Complexity | Best For |

|---|---|---|---|

| Simple LTV | Averages all customer data | Low | Quick, high-level estimates; brands just starting out. |

| Cohort LTV | Groups customers by acquisition date | Medium | Identifying trends and the impact of marketing campaigns. |

| Predictive LTV | Uses AI to forecast future value | High | Optimizing ad spend and proactively retaining top customers. |

Each model builds on the last, giving you a clearer picture as your data and needs grow more complex.

The Predictive LTV Model

Welcome to the future of DTC analytics. While the other models look backward at what has happened, predictive LTV uses AI to forecast future customer value with incredible accuracy.

This is where the manual data crunching ends and AI-driven strategy begins. Predictive models analyze thousands of data points—purchase history, browsing behavior, email engagement—to identify the customers who are most likely to become your future VIPs.

This forward-looking view is a massive competitive advantage. It lets you:

- Identify High-Potential Customers Early: Double down on retaining new customers who show all the signs of becoming high-value buyers.

- Optimize Ad Spend in Real-Time: Confidently bid higher for ad placements that attract users with a high predicted LTV.

- Proactively Prevent Churn: AI can flag valuable customers who are starting to drift away, letting you step in with a personalized offer before they're gone for good.

Platforms like MetricMosaic automate this entire process, turning your raw Shopify data into a clear, predictive roadmap for growth.

Understanding the LTV to CAC Growth Ratio

So you've calculated your LTV. That's a huge step, but the number on its own is a bit like knowing your car's top speed without knowing how much gas is in the tank. To make it truly powerful, you need to pair it with its other half: Customer Acquisition Cost (CAC).

LTV tells you what a customer is worth over time. CAC tells you what it cost to get them in the door. The real magic happens when you see how they balance out.

The LTV to CAC ratio is the ultimate health check for your Shopify brand. It cuts through the noise of vanity metrics and answers the one question every DTC founder loses sleep over: "Is the money I'm spending on marketing actually building a profitable business?"

The 3 to 1 Gold Standard

What's a "good" ratio look like? For most of the eCommerce world, a 3:1 LTV to CAC ratio is the gold standard. It's the sign of a healthy, scalable brand.

Simply put, for every $1 you spend to acquire a customer, you should be making $3 back in net profit over their entire relationship with your brand.

Here’s a quick breakdown of what different ratios are telling you:

- 1:1 Ratio (The Danger Zone): This is a red flag. You're basically lighting money on fire, spending as much to get a customer as they'll ever give you. Your business model isn't working, and something needs to change—fast.

- 3:1 Ratio (The Sweet Spot): You've found it. Your business is profitable, your marketing is working efficiently, and you have a solid green light to keep scaling what you're doing.

- 5:1+ Ratio (A Good Problem to Have): While a high ratio looks great on paper, it might actually mean you're being too conservative. You could be leaving growth on the table by underinvesting in acquisition. It’s time to press the accelerator.

This simple ratio transforms LTV from an abstract number into a real, actionable tool for making smarter budget decisions.

Turning Your Ratio into Strategy

Your LTV to CAC ratio isn't just a report card; it's your brand's compass. It should guide your biggest decisions around growth. For a business to be considered healthy, a CLV:CAC of at least 3:1 is the benchmark, with many investors wanting to see the initial CAC paid back within 12 months.

While a SaaS company might be fine with a longer payback window, DTC brands usually need to see that money back faster—often in 6-12 months—because cash flow is so much tighter. You can learn more about how different businesses use this ratio from Salesforce.

If your ratio is a healthy 3:1 or better, it's a clear signal to double down on the channels that are working. It justifies putting more money behind your ads, content, and partnerships because you have the data to prove the long-term return is there.

On the other hand, if your ratio is dipping below 2:1, it’s time to pump the brakes. This is your cue to figure out what's broken. Is your CAC creeping up? Maybe it's time to optimize your ad campaigns or find more organic channels. Is LTV lagging? Then it's all about retention—improving your post-purchase flow, creating a loyalty program, and finding ways to drive that second and third purchase.

Ultimately, this ratio lets you stop guessing and start balancing your marketing budget with precision, ensuring every dollar spent is building a stronger, more resilient DTC brand.

Automating Your LTV Calculation with AI Analytics

Let's be real. Trying to calculate an accurate customer lifetime value formula in a spreadsheet is a special kind of hell. You're wrestling with VLOOKUPs, exporting messy CSVs from Shopify, and desperately trying to stitch together data from Google Analytics, Meta Ads, and Klaviyo.

The result? An outdated, unreliable number that feels more like a wild guess than a metric you can bet your business on.

This is the exact data trap that holds so many DTC brands back. While you’re buried in manual work, your competitors are moving faster and making smarter calls. This is where modern, AI-powered analytics platforms come in and completely change the game, turning that complexity into clarity.

From Manual Spreadsheets to Real-Time Insights

AI-powered tools like MetricMosaic automate the entire LTV calculation process. Think of them as a central hub that seamlessly plugs into all your essential tools—your Shopify store, ad platforms, email software, you name it. This creates a single, unified view of every customer's journey, giving you an accurate LTV figure in real-time.

No more data silos. No more outdated reports.

Instead, you get a live, dynamic understanding of what your customers are actually worth. You can see it segmented by the campaigns that brought them in, the products they bought first, and how they behave over time. This is how you finally escape spreadsheet chaos and start making truly data-driven decisions.

The Power of Predictive and Conversational AI

But the real magic of modern analytics goes way beyond just automating old-school calculations. AI brings capabilities to the table that, until recently, were only available to enterprise giants with their own data science teams.

AI doesn't just calculate your LTV; it turns it into a strategic weapon. By analyzing thousands of behavioral signals, predictive models can spot your future VIP customers from their very first interaction.

This opens up a whole new playbook for growing your Shopify brand:

- Predictive Insights: AI can forecast the future LTV of new customers with startling accuracy. This gives you the confidence to invest more in acquiring lookalike audiences that mirror your most profitable segments.

- Conversational Analytics: Imagine just asking your data a question in plain English. With next-gen tools, you can type, "What's the 60-day LTV of customers from our last TikTok campaign?" and get an instant, story-driven answer. No need to build complex reports.

This leap from reactive reporting to proactive, conversational analysis lets you uncover hidden opportunities, fine-tune your ad spend with precision, and focus your retention efforts where they’ll make the biggest dent in your bottom line.

Turning LTV Insights Into Profitable Actions

Knowing your LTV is one thing, but the real magic happens when you turn that number into action. For Shopify founders, LTV isn't just another metric for a dashboard; it’s a playbook for making smarter, more profitable decisions across your entire business.

An accurate LTV gives you the clarity to stop reacting and start investing strategically. It points a big, bright arrow at exactly where you should focus your resources—time, money, and energy—to get the best long-term results.

Your LTV Action Plan

Once you have a reliable LTV figure, especially one crunched by an AI-powered analytics tool, you can start making moves that show up on the bottom line.

LTV is the bridge between what you spend on marketing and what you actually earn in profit. It’s the number that finally connects the dots, letting you build a sustainable growth engine instead of just chasing one-off sales.

Here are a few practical ways you can put LTV to work today:

Optimize Ad Spend with Precision: Stop guessing which ad channels are working. When you analyze LTV by acquisition source, you can see which platforms—Meta, Google, TikTok—are actually bringing you your most valuable customers. If you discover that customers from Google Ads have a 2x higher LTV than those from Meta, you can confidently shift your budget, even if their initial CAC is a bit higher.

Enhance Customer Retention Efforts: A huge part of growing LTV is simply keeping customers around longer. You can do this by deploying proactive churn marketing strategies. Predictive tools can flag high-LTV customers who are starting to drift away, giving you a chance to step in. You could target this specific group with a personalized "we miss you" campaign, a special offer, or early access to a new product to win them back before they're gone for good.

Refine Your Product Strategy: Go dig into the purchase history of your top LTV cohorts. What did they buy first? What products do they tend to buy together? These insights are absolute gold. They can help you create smarter product bundles, dial in your cross-sell recommendations, and even guide your next product launch to be something your best customers will jump on.

Your LTV Questions Answered

We’ve waded through the formulas, crunched the numbers, and talked strategy. But I know there are still some nagging questions that pop up when you're in the trenches running your Shopify store. Let's tackle a few of the most common ones I hear from founders.

How Often Should I Be Calculating LTV?

For most DTC brands, a monthly and quarterly rhythm works best. Think of it like this: monthly checks are your tactical pulse-checks. They help you see if that new email flow or ad campaign is actually moving the needle in the short term.

Quarterly reviews, on the other hand, are for a more strategic, zoomed-out view. This is where you can spot the bigger, more stable trends in customer value and make long-term decisions. Of course, an AI analytics platform that does the heavy lifting can give you this in real-time, letting you keep an eye on it whenever you want without getting bogged down in spreadsheets.

What’s a “Good” LTV for an Ecommerce Brand?

This is the million-dollar question, but the honest answer is: it depends. A "good" LTV is meaningless without knowing what it costs you to get that customer in the first place. It's all about context.

The real metric to obsess over is the LTV to CAC ratio. A 3:1 ratio is widely considered the gold standard. It means for every dollar you put into acquiring a customer, you're getting three dollars back over their lifetime with you. If you're hitting that, you're in a very healthy spot.

Can I Actually Improve My LTV Without Just Spending More on Ads?

Absolutely. In fact, some of the most powerful LTV levers have nothing to do with acquisition spend. It's all about retention.

Focus your energy on what happens after the first purchase. Are you delighting them with an incredible unboxing experience? Do you have a loyalty program that makes them feel like a VIP? Are you using email and SMS to build a relationship and encourage that second or third purchase? Even just actively gathering customer feedback to make your products better will increase how often they buy and how long they stick around—directly bumping up your LTV.

Ready to stop guessing and start growing with a clear, automated view of your LTV? MetricMosaic unifies all your Shopify data into one place, delivering predictive insights that turn complexity into profitable action. Start your free trial today.